We analysed the Gilbertson & Page website to better understand its position within its niche. Our in-depth website analysis revealed some interesting insights. In this article, we will present the data we found. As well as put forward a few suggestions of our own. Especially on how the company can avoid losing their industry leading status.

Introduction

Gilbertson & Page have been manufacturing dog food since 1873. Their products are sold via their own website and also on other marketplaces such as Amazon and online pet stores.

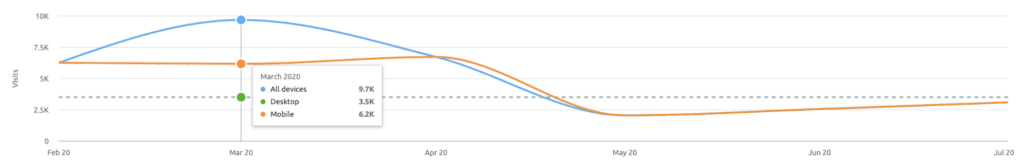

In 2020, Gilbertson & Page had a 53% increase in their website traffic between February and March. From 6300 website visits to 9700 website visits.

Those website visits fell to 2200 by May 2020 and then rose again to 3100 in July 2020.

This remains a 68% drop from the 9700 visits they had 4 months earlier.

This remains a 68% drop from the 9700 visits they had 4 months earlier.

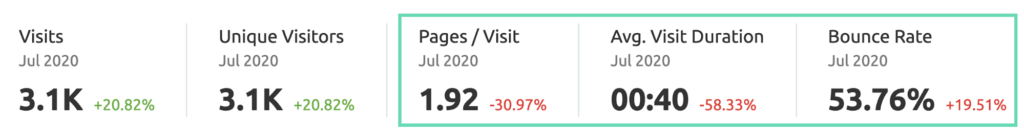

And even though the graph shows a gentle improvement taking place between June and July 2020, website visitors behaviour on the website is less than satisfactory.

The number of pages viewed and the amount of time spent on the website have fallen.

The number of pages viewed and the amount of time spent on the website have fallen.

In one month, their visitors went from spending an average of a minute and a half to just 40 seconds on the website.

As such, the website’ bounce rate has increased by almost 20%.

A Closer Look at Gilbertson & Page

In this article, we will cover the following areas:

Competitive Landscape

We will evaluate Gilbertson & Page’s market and see how companies in the industry grow. We will also identify the main companies that are worth paying attention to.

Website Analysis

We will be analysing the website’s on-page SEO and conducting a keyword analysis.

Content Audit

The purpose of the content audit is to understand the current state of the Gilbertson & Page website. From there, we can understand how they can potentially leverage existing content to improve their SEO.

Backlink Analysis

We will examine the external links that point to Gilbertson & Page. As well as taking into consideration the amount of and the quality of these backlinks.

Subsequently, this will help give us a better understanding of their website’s ability to rank well in search engine results.

First, we will provide a brief overview of Gilbertson & Page.

About Gilbertson & Page

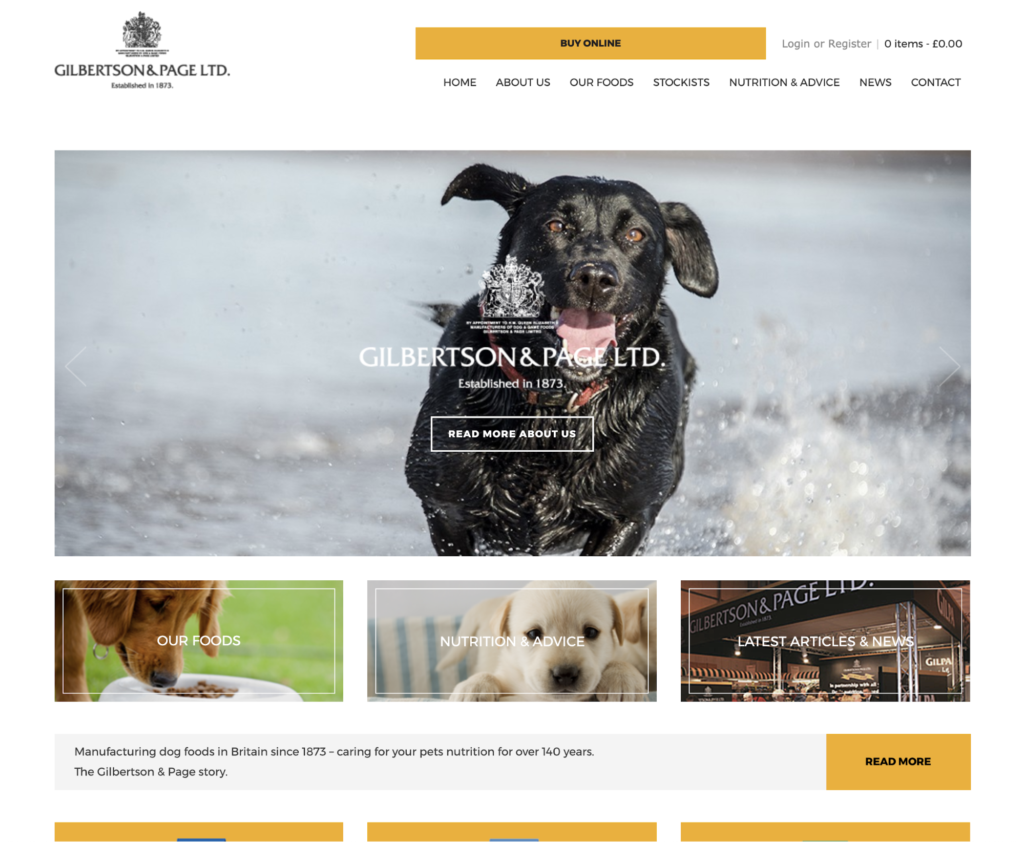

Visit the website: gilpa.co.uk

Gilbertson & Page is a privately-owned, family business based in Hertfordshire.

At the end of 2019, their turnover was £31.27 million which was a £3.28m increase from 2018.

Gilbertson & Page hold the Royal Warrant. This was first received in 1884 from Queen Victoria.

The Royal Warrant enables a supplier to advertise the fact that they supply to the royal family.

Furthermore, Gilbertson & Page are one of only 800 companies that hold The Royal Warrant.

Market Overview

Gilbertson & Page are part of the Prepared Pet Food Manufacturing Industry.

The Prepared Pet Food Manufacturing industry involves the manufacture of prepared feed for domestic pets. It is primarily focused on dogs and cats.

In 2019, the dog population in the UK was 9.9 million and 26% of all UK adults own a dog. In that year alone, the Pet Food Manufacturing Industry had an estimated market size of £3 billion.

The companies with the largest market share in the UK Prepared Pet Food Manufacturing industry include two giants:

- Mars Petcare UK

- Nestle Purina PetCare (UK) Ltd

The Competitive Landscape

In this section we will take a look at the growth of both Gilbertson & Page’s industry competitors and organic competitors.

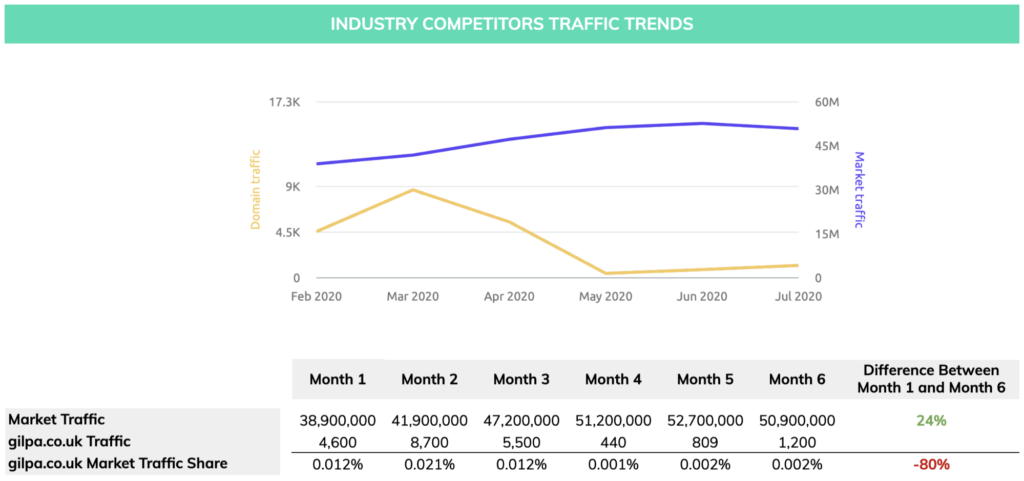

Industry Competitor Traffic

Gilbertson & Page’s industry competitor traffic was a total 50.9 million website visits in July 2020.

However, Gilbertson & Page received less than 1% of that traffic.

Between February and July 2020, overall industry competitor market traffic increased by 24%.

During the same period, the Gilbertson & Page share of market traffic has shrunk by 80%. And, it has never been above 1%.

Main Industry Competitors

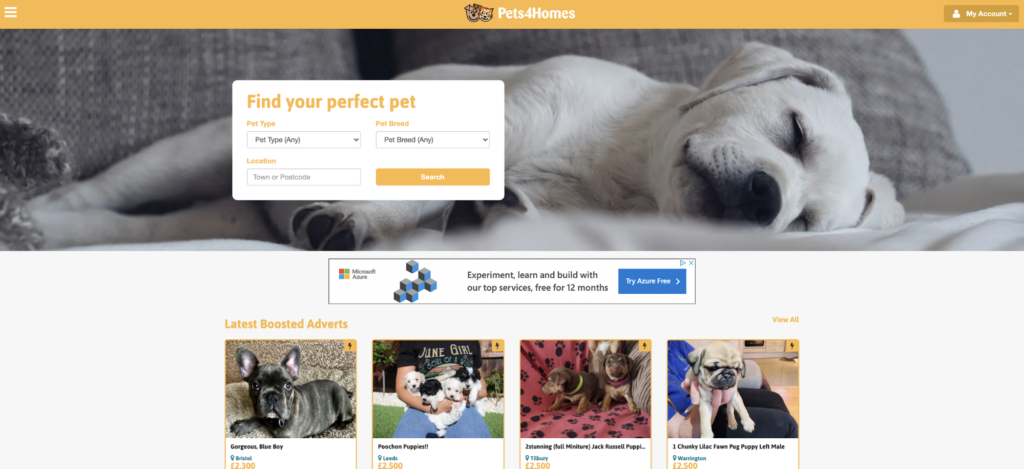

Pets 4 Homes

Gilbertson & Page’s main industry competitor is pets4homes.co.uk, it has a 26.4% market traffic share.

It is important to note that pets4homes.co.uk is neither a dog food manufacturer nor a seller of pet food of any kind.

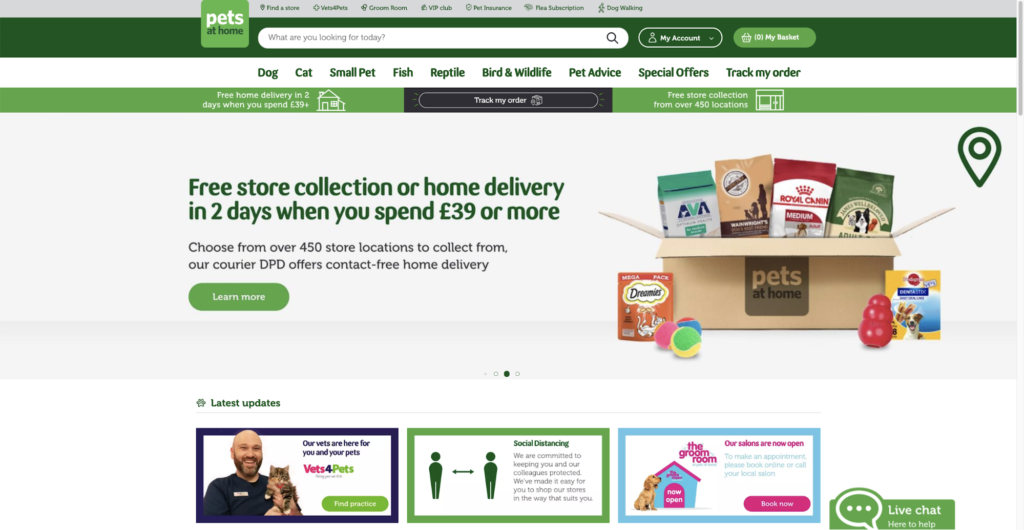

Pets At Home

The website petsathome.com has the second biggest share of industry market traffic at 15%.

Petsathome.com consider themselves “the UK’s leading pet care business, providing pet owners with everything they need to be able to look after their pet”.

And this of course, includes dog food.

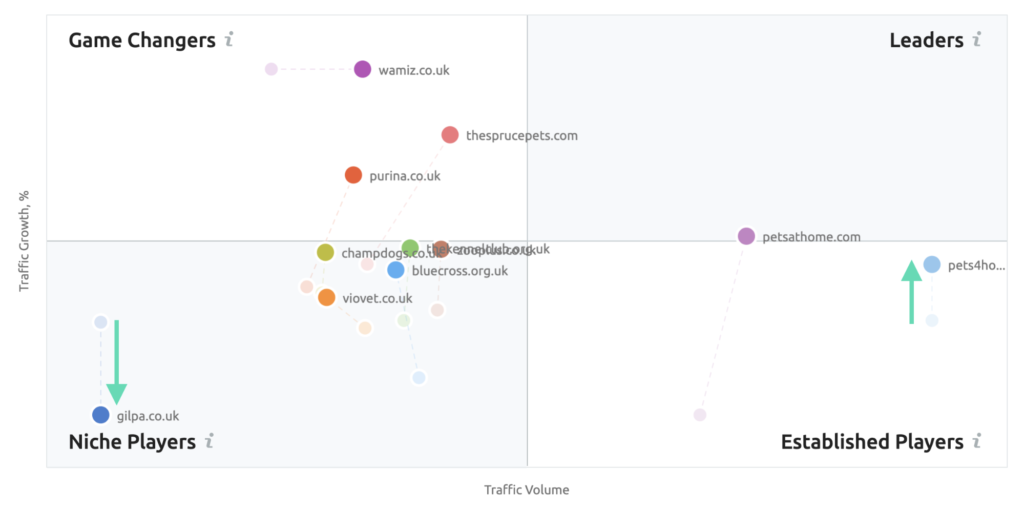

Industry Competitors Traffic Growth

Gilbertson & Page’s main industry competitor, pets4homes.co.uk, was an established player in July 2019. It had a fairly steady flow of consistent traffic.

During that same period, Gilbertson & Page did not have a large online audience. As such, their traffic was not actively growing.

At this point, there was an opportunity for Gilbertson & Page to invest in their marketing. This would have been beneficial for Gilbertson & Page and the ideal way to speed up their growth rate.

At this point, there was an opportunity for Gilbertson & Page to invest in their marketing. This would have been beneficial for Gilbertson & Page and the ideal way to speed up their growth rate.

One year later, Gilbertson & Page has descended into greater online obscurity. Whereas, every one of their Top 10 industry competitors – including pets4homes.co.uk – have increased their traffic.

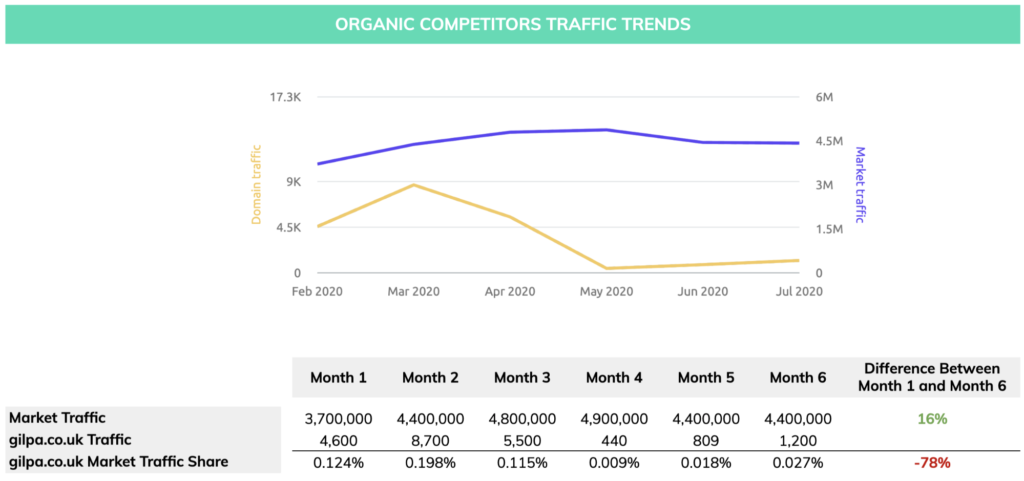

Organic Competitor Traffic

Gilbertson & Page’s organic competitor traffic was at a total of 4.4 million website visits in July 2020.

The Gilbertson & Page website received less than 1% of that traffic.

Between February and July 2020, overall industry competitor market traffic increased by 16%.

During the same period, Gilbertson and Page’s share of market traffic shrunk.

Although, it did shrink less than it did against its industry competitors. Yet, this did little to change the website. As demonstrated by the fact it received less than 1% of all organic market traffic.

Main Organic Competitors

Viovet

Gilbertson & Page’s main organic competitor is viovet.co.uk with a 18.97% market traffic share.

VioVet Ltd offers a variety of pet and horse supplies. This includes prescription and non-prescription medications, food, toys and equipment.

Vet UK

The website vetuk.co.uk has the second biggest share of organic market traffic at 14.48%.

VetUK is a licensed supplier of pet medications. They also sell Cat Food, Dog Food, Flea Treatments and Worming Tablets.

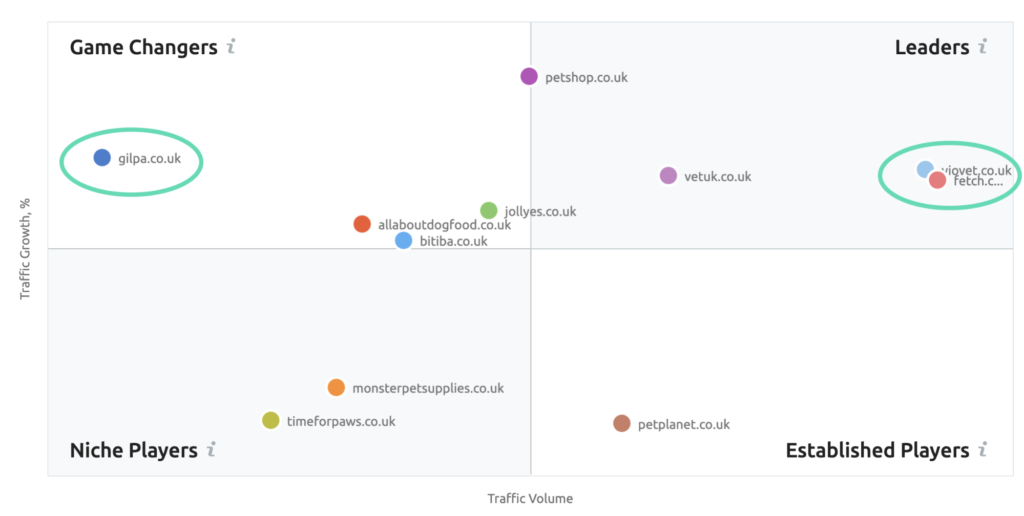

Organic Competitor Traffic Growth

The Gilbertson & Page main organic competitor, viovet.co.uk, was a market traffic leader in July 2019. They were considered a fast growing website that was attracting a large audience.

At that same period, Gilbertson & Page was seen as a Game Changer. This is because they were considered to have a high growth potential.

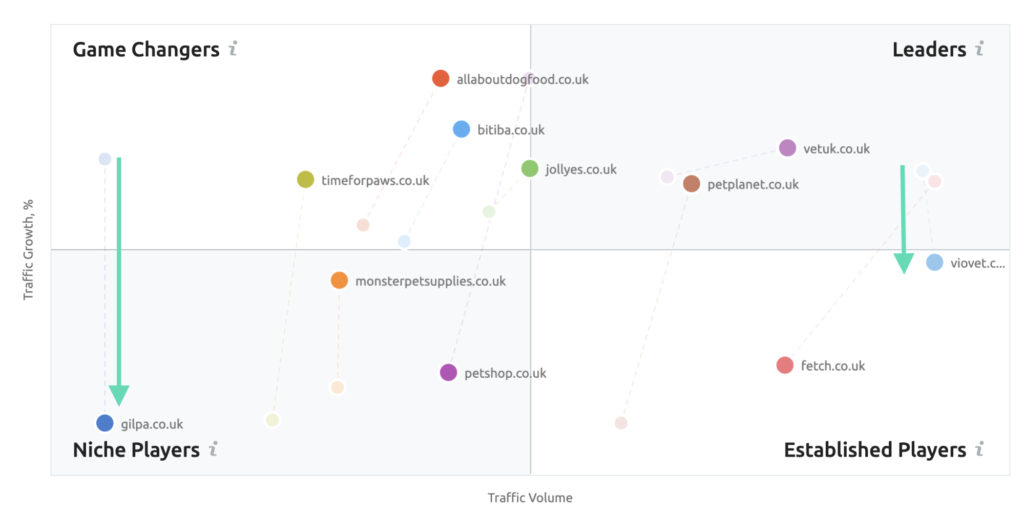

However, 12 months later, Gilbertson & Page lost a significant amount of traffic.

Their traffic growth decreased by 73.5%.

Gilbertson & Page is consistently losing ground against its industry competitors and its organic competitors.

In addition, Gilbertson & Page are competing with companies who sell dog food as an additional product. This is concerning. Specifically, when Gilbertson & Page’s core focus is on dog food.

Let’s dive into what has been going wrong for them and how they can improve their online presence.

Gilbertson & Page Website Analysis

On-Page SEO

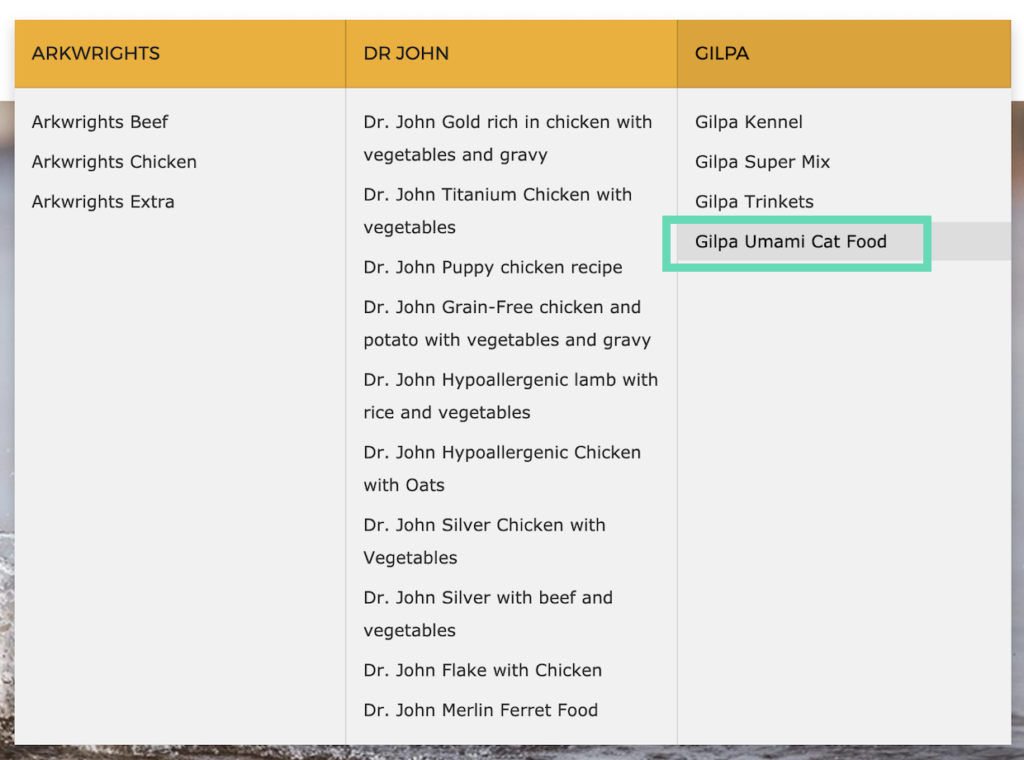

Gilbertson & Page are dog food manufacturers and dog food sellers.

The Page Title and Meta Description for Gilbertson & Page’s homepage states that they make dog food. However, there is absolutely no mention of the fact that they sell dog food.

Actually, Gilbertson & Page also sell cat food, which also presents a missed opportunity.

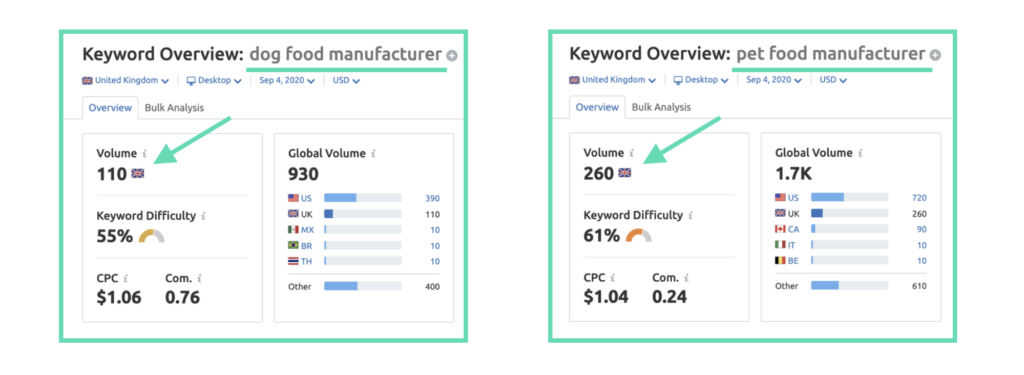

In other words, they could benefit from optimising their website for multiple keywords. Both “dog food manufacturer” and “pet food manufacturer”.

Subsequently, this is a combined total monthly volume of 370 in the UK. And, a total global volume of 2630.

But, let’s focus solely on the keywords “dog food” and “dog food manufacturer”. These words are not given any prominence on the website’s homepage.

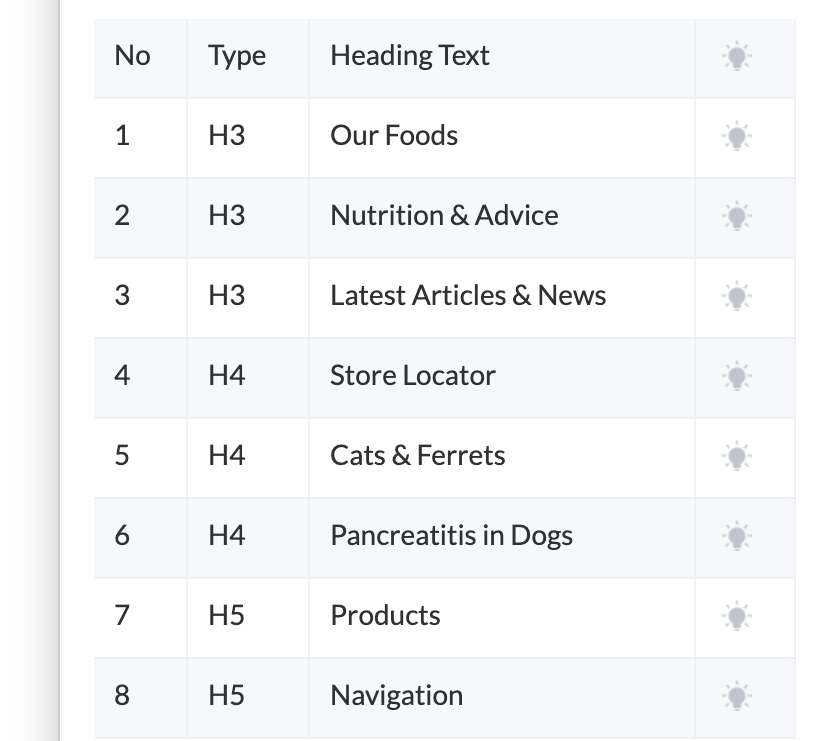

There are 8 headings on the homepage; none of them use these keywords or phrases.

In addition to this, the schema that allows the website to communicate information to search engines like Google is incomplete.

There is no H1 tag and there are no H2 tags.

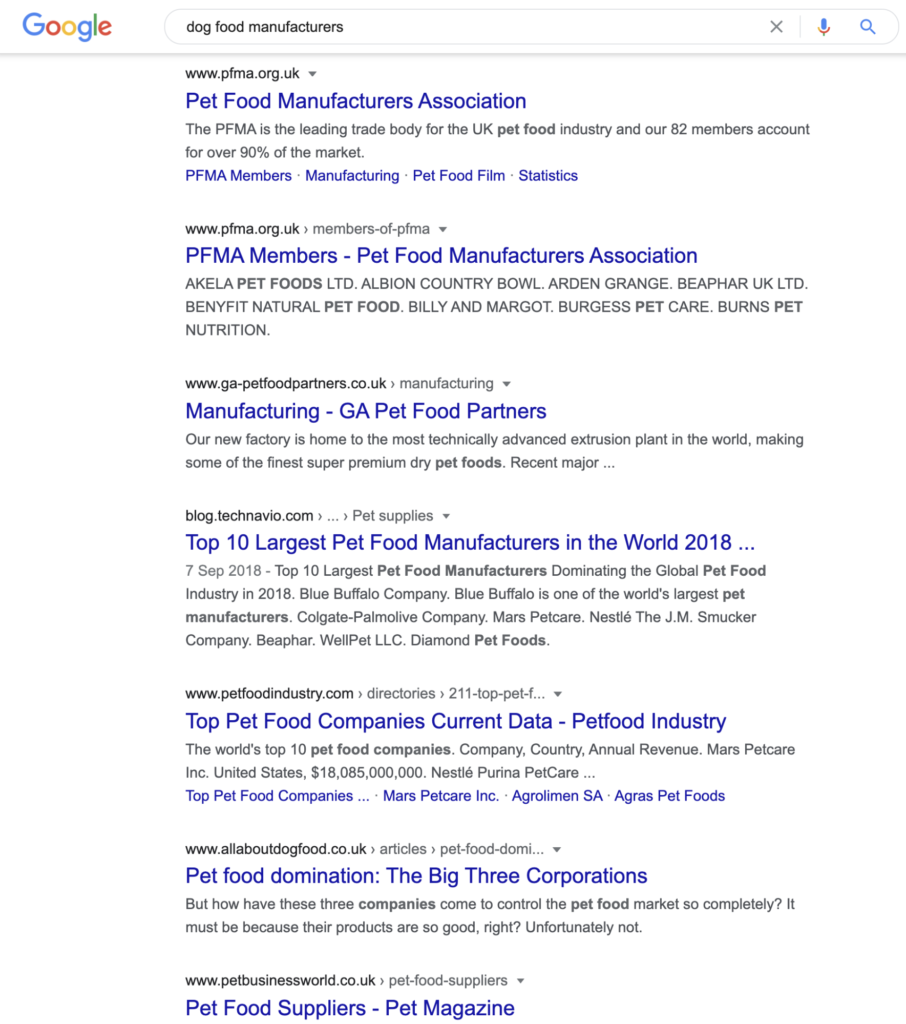

Despite this, we still think it is worth Gilbertson & Page targeting the keyword “pet food manufacturer”.

This is because if we search for “dog food manufacturers” we only receive results containing the word “pet”.

Let’s analyse the keywords that Gilbertson & Page currently rank for. This will help us infer what they need to do to improve their performance in the search engines.

Keyword Analysis

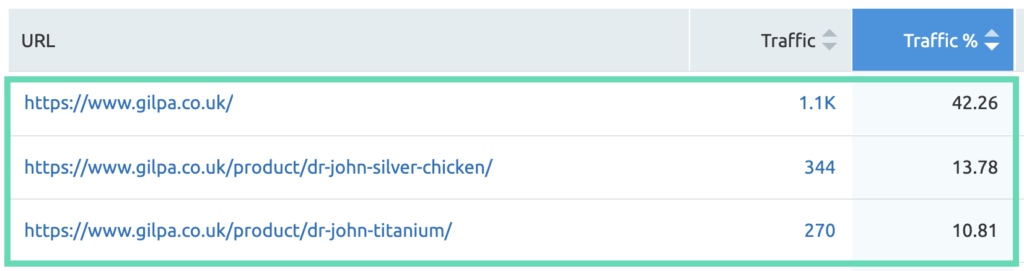

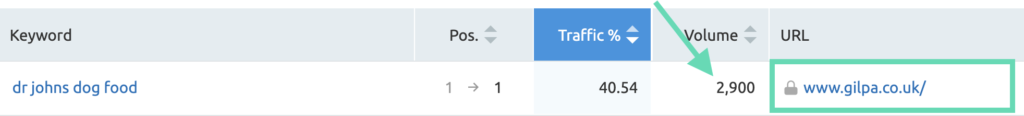

In the UK, Gilbertson & Page receives the majority of its traffic (40%) from the keyword: “dr johns dog food”.

This keyword has an estimated 2900 monthly searches.

This is a specific commercial intent keyword such as, ‘Audi SQ8’ or ‘Samsung Galaxy Note’.

The Gilbertson & Page website ranks number 1 in the search engine results for this keyword. Despite this, the search traffic sends searchers to their generic homepage.

This is not a problem, but the Gilbertson & Page homepage is not designed to convert this traffic into sales.

It would be better for that particular traffic to be sent to an optimised product landing page. One with a page title containing the keyword: “dr johns dog food”.

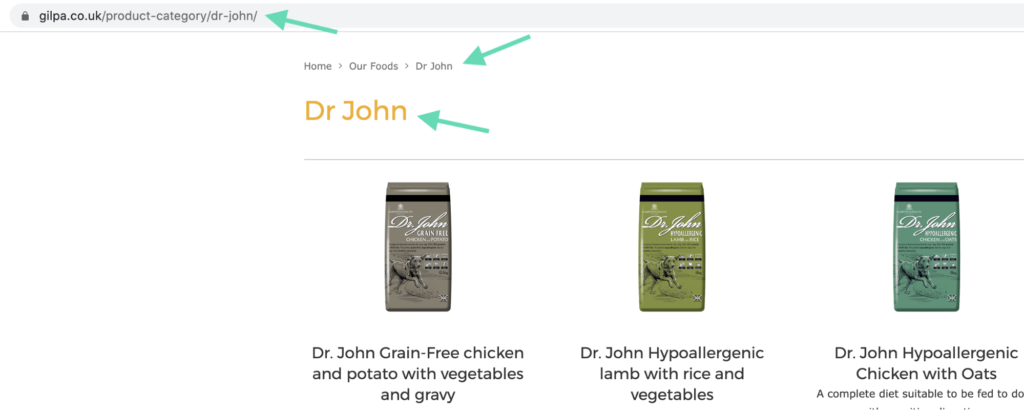

The website does have a page that could receive this traffic. However, this page only uses “Dr John” in the page URL, page breadcrumbs and page title.

This distinct lack of optimisation for customer experience (and search engines) is pretty common throughout the Gilbertson & Page website.

Let’s move on and examine the website’s content.

Content Audit

The Gilbertson & Page website has 1160 pages.

Only a third of those pages (373 pages) rank in Google’s Top 100 organic search results.

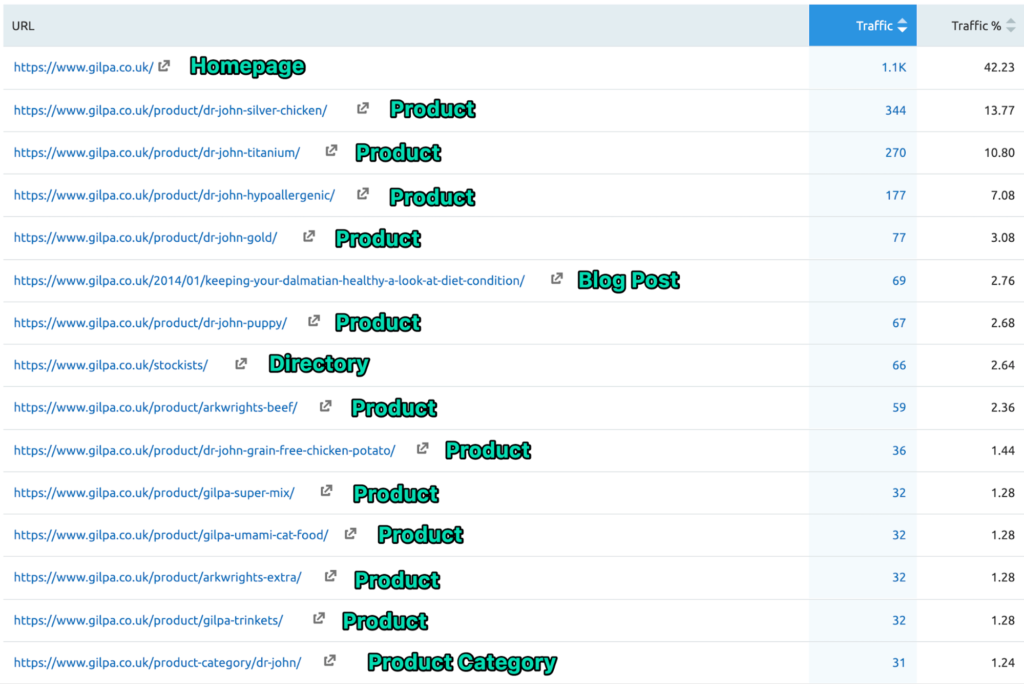

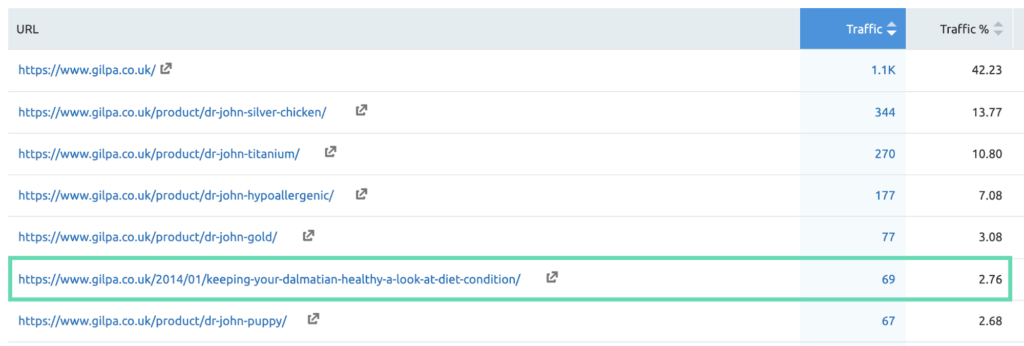

Here are the top 15 pages on the Gilbertson & Page website:

These 15 pages account for 95% of the website’s traffic. We’ve broken these down into categories.

Product Pages

47% of the top 15 pages are product pages.

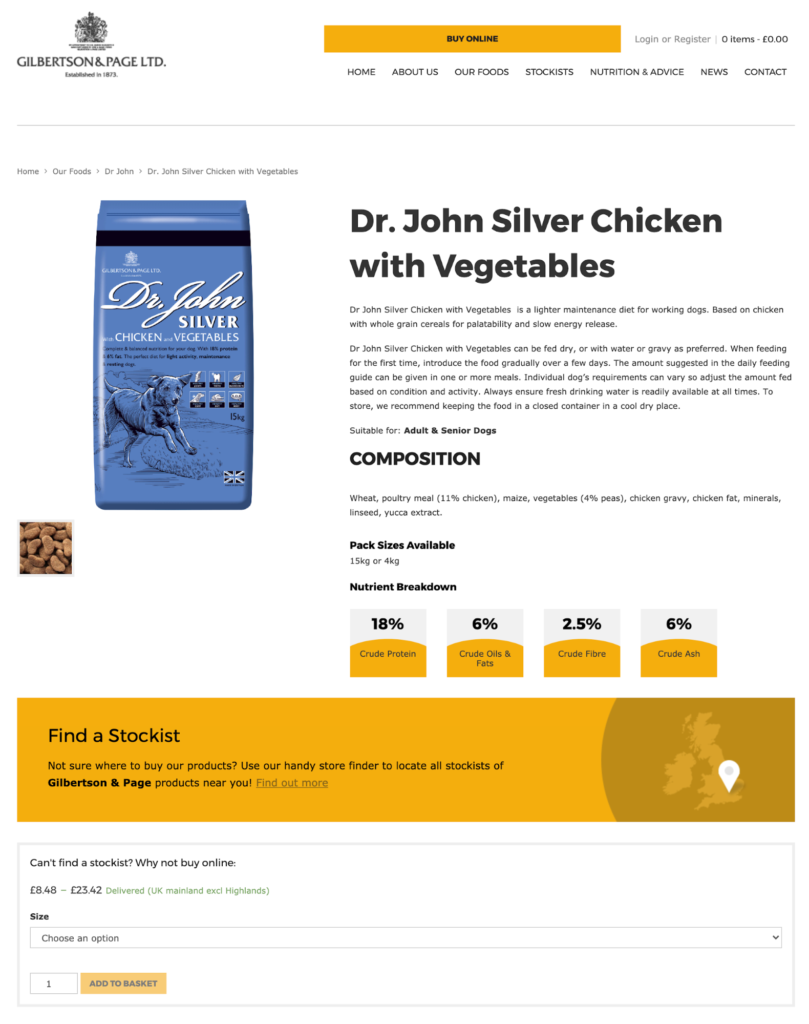

For example, this one:

There are a couple of major issues with these product pages. But we’ll pause and discuss these in a moment.

So, back to the main issue at hand; 47% of the top 15 pages are product pages.

Interestingly, there are only 18 product pages on the entire website that rank in Google’s Top 100 organic search results.

Therefore, only 4% of the 373 pages that rank in the search engines are product pages.

So, what are the other 355 pages about? Let’s take a look.

Stockist Pages

Well, 233 pages out of those 355 pages are stockist pages.

These pages account for 62% of the total pages that rank in the search engines.

All of these stockist pages look like this:

Completely void of any content. Just a Page Title.

And, no call-to-action other than the “Buy Online” button in the website header.

On the subject of call-to-actions, let’s return to those 18 product pages.

It’s surprising that the Gilbertson & Page website even has an e-commerce component. Especially since it does very little to focus on sales.

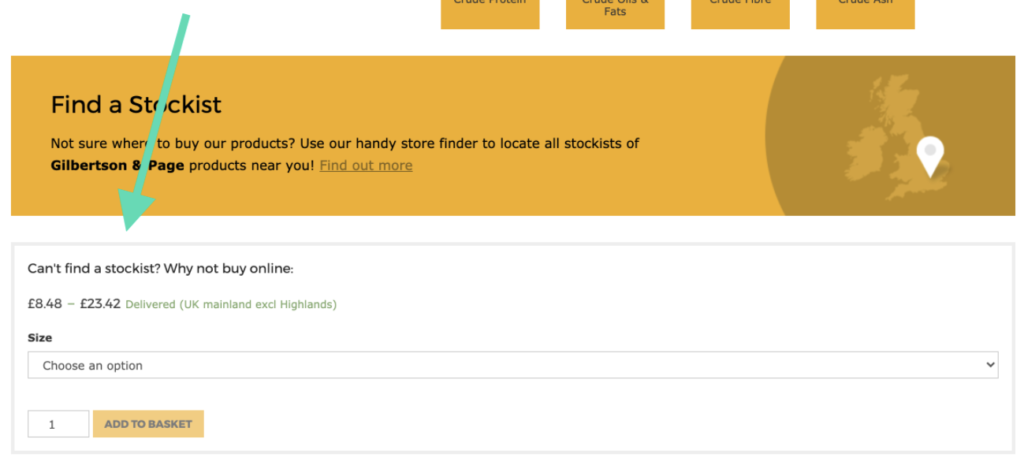

When you land on any product page, the most important call-to-action is the ‘Find a Stockist’ banner.

Underneath that banner, almost as an afterthought, is the start of the website’s checkout process. This doesn’t make sense. Surely, Gilbertson & Page should want to prioritise their own sales before promoting their stockists?

To recap, the website content consists of:

- 18 Product Pages (4%)

- 233 Stockist Pages (62%)

None of these pages do well to satisfy customers or search engines.

That’s 251 pages. What other types of content does the website have?

Blog Pages

The vast majority of the remaining pages on the website are blog pages.

There are 117 blog pages and the first blog post was published in August 2013.

Their last post was published in August 2020.

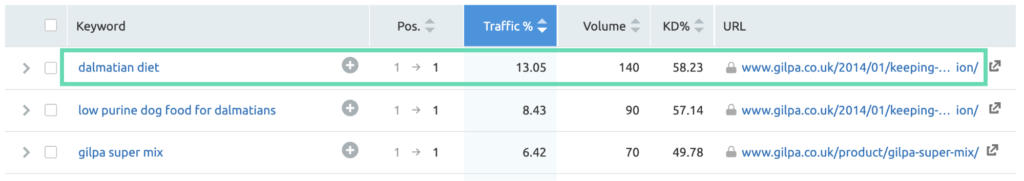

And, the best performing blog post is entitled Keeping your Dalmatian Healthy – A Look at Diet & Condition.

This post was published in January 2014 and it is the 6th most important page on the website.

The post contains 21 keywords with a total estimated monthly volume of 3240. It also brings in the bulk of traffic coming from the US.

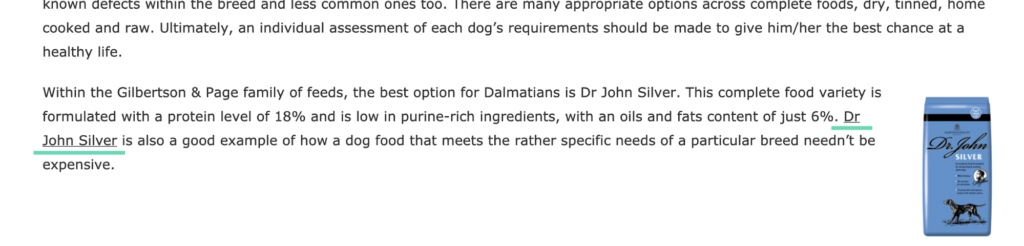

Unfortunately, as we have seen with all the pages on the website, this blog post is not optimised for conversions.

The only attempt to convert the reader into a buyer is hidden at the bottom of the 1260 word article. We’ve underlined that link in the image below:

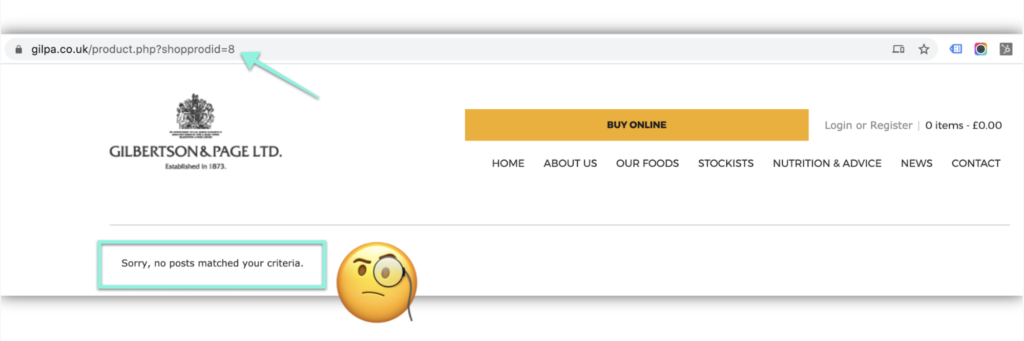

Sadly, clicking on that link sends you to the following page:

Oh, dear!

The page is empty and the URL is not optimised for search engines or user satisfaction.

It doesn’t contain a single keyword either.

We think the product line and website have been updated but some pages like this blog post were overlooked.

However, there are a couple of additional errors on this page.

Firstly, just as we have seen with all pages on the website, this blog post is not optimised for users.

For example, there is a super tiny product image. One that intuitively should lead to a product page when clicked.

Unfortunately a click on this image only opens a larger image in the same tab.

Any website visitor who clicks on the image is obliged to click back on their browser to return.

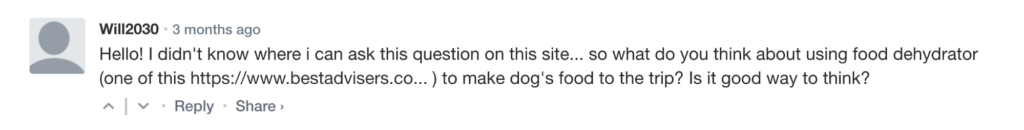

In addition, a question that a website visitor has asked in the comments has been left unanswered for 3 months.

This is not good at all.

As a result, it’s not hard to imagine how other website visitors may view commenting as a pointless activity. This is because Gilbertson & Page do not appear to interact with their potential customers.

“Whenever you receive a genuine blog comment, it’s a good idea to reply to it. Even if the comment doesn’t actively probe a response…[they’re] inviting you to speak with them – a gold dust opportunity. ”

Why You Should Reply to All Accepted Blog Comments (2020)

Finally, let’s analyse the amount and the quality of Gilbertson & Page backlinks. This will help give us an indication of the website’s ability to rank well in search engine results.

Backlink Analysis

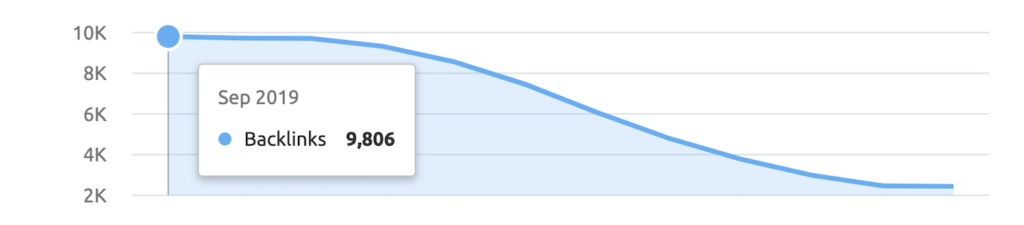

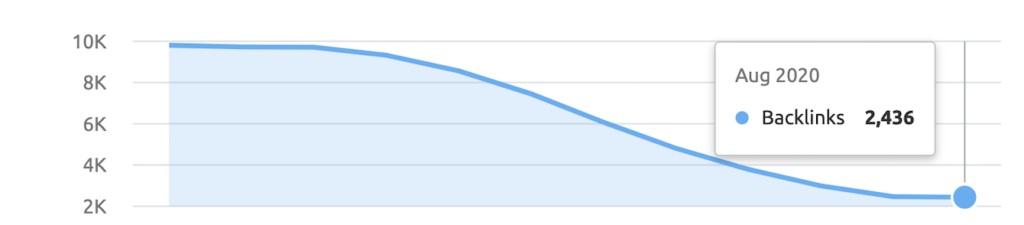

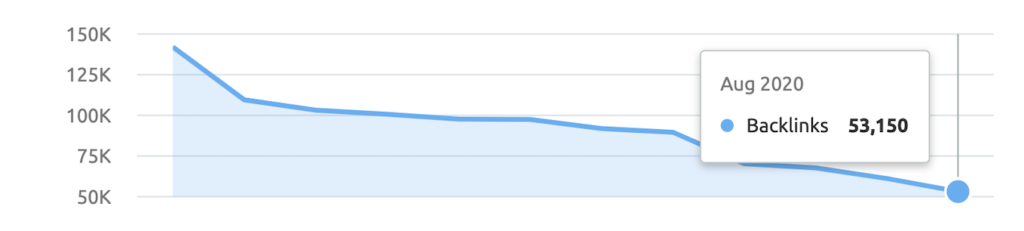

In September 2019, Gilbertson & Page had 9,806 backlinks.

Just under a year later, the number of backlinks had decreased by 75% to 2,436.

Let’s get some perspective by looking at the number of backlinks for Gilbertson & Page’s main industry competitor (pets4homes.co.uk) and their main organic competitor (viovet.co.uk).

Pets 4 Homes Backlinks

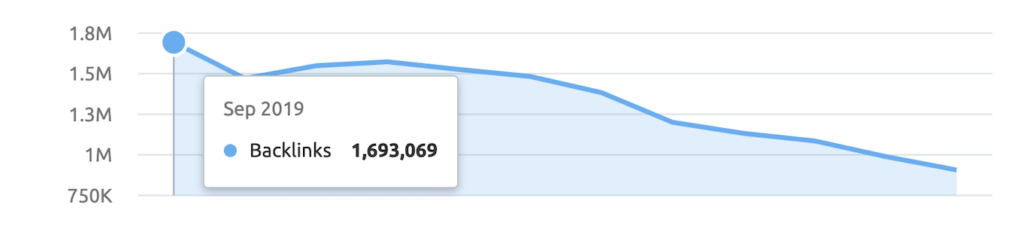

In September 2019, Pets 4 Homes (Gilbertson & Page’s main industry competitor) had 1,693,069 backlinks.

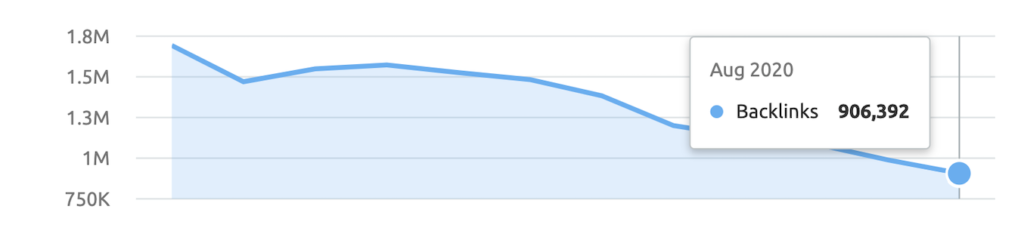

However, we can see the same downward trend. By August 2020, Pets 4 Homes’ backlinks had dropped 46% to 906,392.

Viovet Backlinks

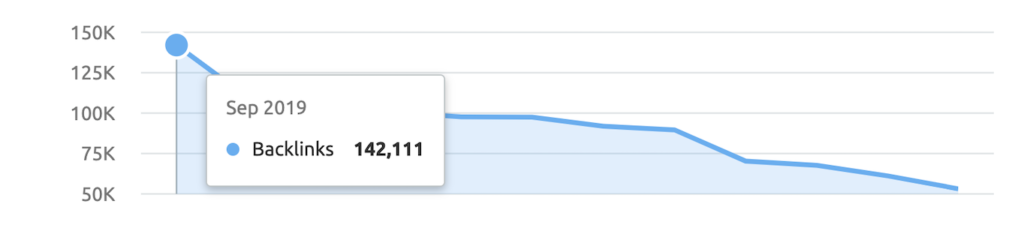

In comparison, in September 2019, Viovet (Gilbertson & Page’s main organic competitor) had 142,111 backlinks.

Once again, we see the same decrease in the number of backlinks. Viovet lost 62% of their backlinks by August 2020.

From this, we can conclude that there was an industry-wide reason for the decrease in the number of backlinks.

However, it’s clear that Gilbertson & Page needs to increase the number of quality backlinks it currently has to stay competitive.

Backlink Quality

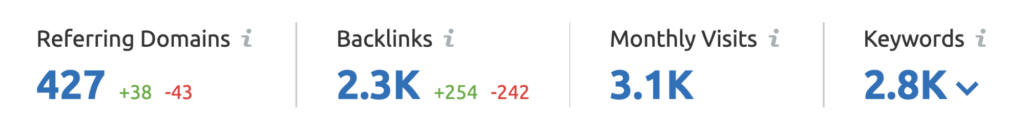

Gilbertson & Page currently has 2300 backlinks referred by 427 domains. These backlinks have resulted in just over 3000 visits between July and August 2020.

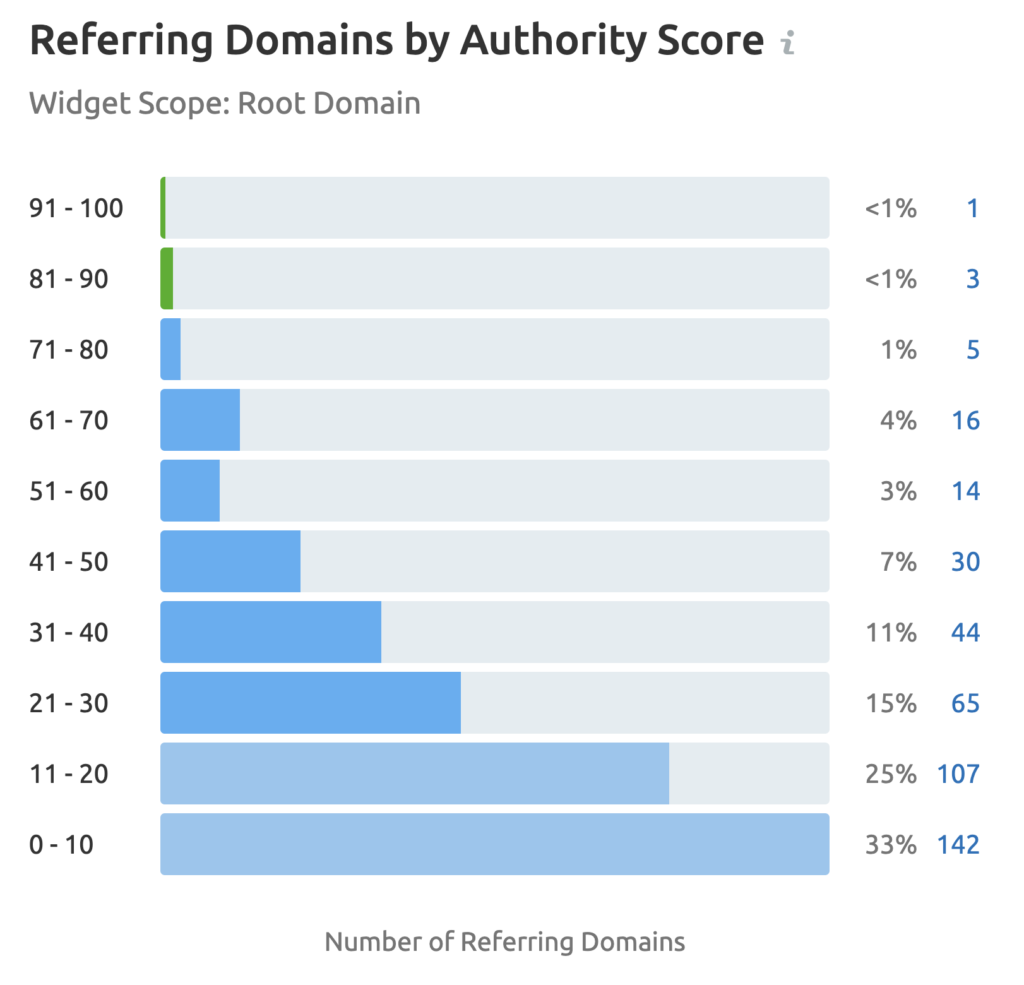

When we take a closer look at the referring domains of these backlinks, we can see that 58% have an Authority Score below 20.

These domains are providing low-quality backlinks.

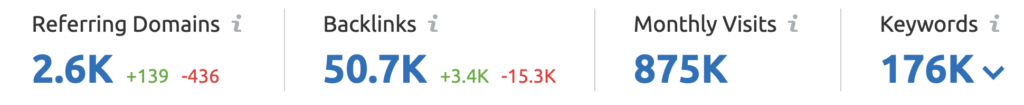

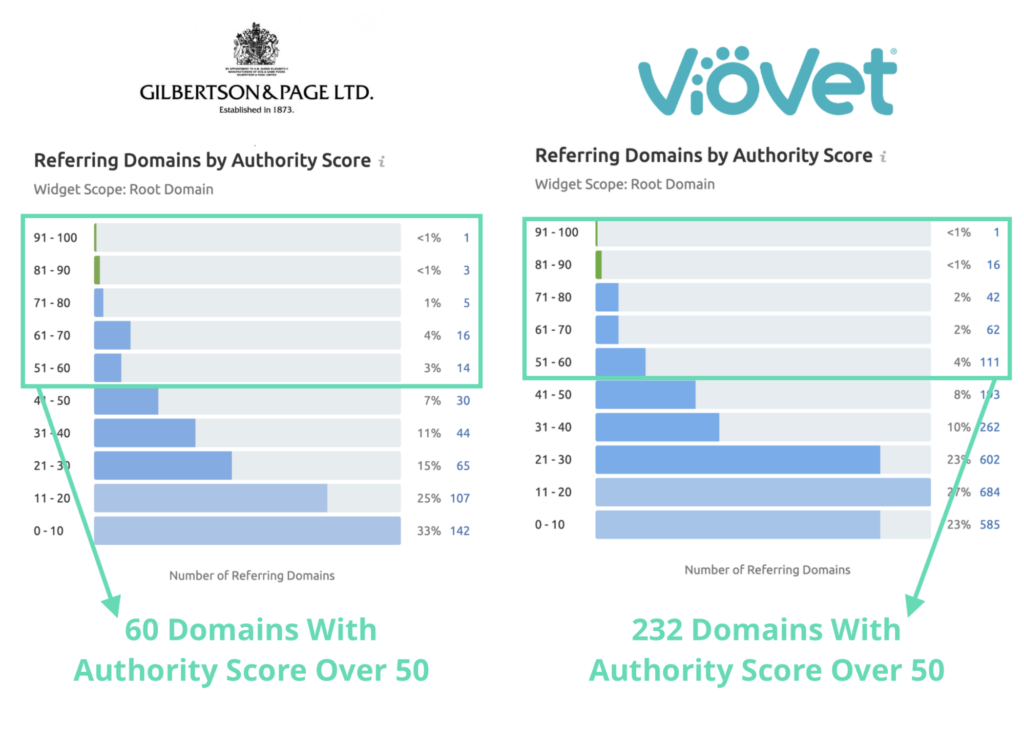

In comparison, let’s look at the Backlink Analysis for Gilbertson & Page’s top organic competitor, viovet.co.uk.

Viovet currently has just over 50,000 backlinks.

These backlinks are being referred by 2600 domains, resulting in 875,000 between July and August 2020.

However, it is not just the amount of backlinks that Viovet has, it is the quality of those backlinks.

Gilbertson & Page has 60 referring domains that have an Authority Score over 50.

Viovet has almost 4 times the amount of high authority domains linking to their website.

Conclusion

There are a number of serious issues with the Gilbertson & Page website. However, these should be considered lucrative opportunities for improvement.

If a robust marketing strategy was implemented, it could propel Gilbertson & Page to the top of the organic rankings.

Gilbertson & Page need to decide on the overall purpose of their website. They need to answer questions such as:

- Is the website simply a directory for stockists of its products?

- Are they interested in online revenue from selling pet food?

- Do they understand the importance of creating regular and valuable content?

The website’s descent into online obscurity is clearly due to neglect.

For Gilbertson & Page to regain and remain a Pet Food Industry Leader things need to change. Specifically, there are a few things that need urgent attention.

The priority areas that require improvement are:

- Identifying their target audience

- Updating and optimising their most popular pages

- Undertaking keyword research and competitor analysis

- Creating regular keyword optimised content

- Creating dedicated product pages to increase revenue

With just a little bit of work on just one or two of these areas, Gilbertson & Page should begin to see significant improvement to their key metrics.

This would also help them move towards a site which is clear. More importantly, to transition to a site with the ability to turn traffic into sales.

From there, they could start to work on other areas such as content marketing, paid and social media. Then, they could focus on aligning these strategies towards a common goal.

As a result this could help Gilbertson & Page avoid losing their position as a Pet Food Industry Leader.

Do you want an honest and upfront conversation about your

business?

We’ve worked with hundreds of companies to help them understand how best to grow their businesses online.

Our analysis and strategies provide practical and logical roadmaps. These help

companies understand where they stand currently, what growth is possible and how to get there.

We want to provide companies with focused growth and to ensure they have

marketing campaigns that are completely aligned to agreed goals.

If you would like to have a conversation about your company, get in touch. Alternatively, submit your details for a free personalised competitor report.